Key takeaways

Competition and industry disruption are driving the majority of semiconductor organizations to transform.

Moore’s Law constraints are in part driving semiconductor industry changes as companies invest in retention and improvement of core operational competencies while expanding into new markets.

Close to half of semiconductor companies are focused on new markets and experimenting with new go-to-market strategies, such as selling integrated solutions and experimenting with new business models.

Technology trends driving business transformation include integrated AI, edge computing, 5G communications and IoT products and/or services.

Why this matters

A spotlight on the semiconductor industry from manufacturers, governments, and even consumers has emphasized a shortage of semiconductors as the main growth and supply constraint for certain end markets. Yet, many semiconductor companies, recognizing a need for change even prior to the pandemic, already had transformation strategies underway before the onset of these shortages. In order to understand the cause of semiconductor company transformation, Deloitte, in collaboration with the Global Semiconductor Alliance (GSA), conducted a survey in spring of 2021 of more than 40 top semiconductor industry executives. The “Deloitte-GSA Semiconductor Transformation Study” revealed four primary characteristics of industry transformations, including: market disruption, new technology-driven markets, innovative business models, and digital transformation.

Dynamic disruptions

A plethora of industry disruptions such as new end markets driven by trending technologies, customers emerging as competitors with in-house chip design capabilities, and global trade dynamics and investment have made a forceful impact. While these factors were all in play pre-pandemic and forced semiconductor companies to rethink products, operating models and capabilities, the pandemic simply magnified many of these factors, resulting in an accelerated period of change.

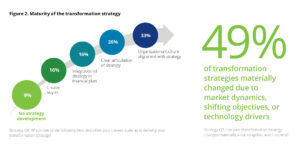

The survey revealed that 49% of semiconductor companies have had to materially modify their transformation strategy to adapt to changes in the market, strategic objectives, or technology.

Only one-third of companies have full organizational/culture alignment with their transformation strategy.

Fifty-six percent (56%) of respondents cite competition and industry disruption as the major drivers of their need to change.

Fifty-one percent (51%) of respondents say that transformation will address competitive moves/threats.

Industry consolidation and supply network issues ranked a distant second and third among issues that transformation will address.

“As the Deloitte-GSA study spotlights, the need for semiconductor industry transformation goes far beyond supply chain challenges and COVID-related disruptions. As with any time of crisis, opportunities exist for companies to address inefficiencies. By instituting fundamental change, organizations can position themselves to boost their resiliency, thereby being better equipped to face future obstacles.”

– Paul Silverglate, vice chairman, Deloitte LLP and U.S. technology sector leader

New frontiers

Sales and marketing teams are driving over one-third of semiconductor transformations, largely focused on expanding into new technology-driven markets and gaining a competitive edge and market share. However, Moore’s Law constraints are still driving some transformations, which is expected because companies must invest to retain and improve core operational competencies, even as they expand into new markets.

Thirty-five percent (35%) of respondents expect sales and marketing to lead business transformation.

Expanding products, markets and sales is the key long-term strategic objective of transformation for 35% of respondents.

Twenty-six percent (26%) of respondents said increasing competitiveness and market share is the key long-term strategic objective of transformation.

Only 14% of respondents said that enhancing customer experience and engagement was a key long-term strategic objective as part of their company’s transformation.

Integrated AI is the top technology trend driving business transformation for 40% of respondents, with edge computing coming in second at 35%, and 5G communications ranking third at 33%.

Innovative models

Chip and hardware companies are offering non-traditional revenue and transaction models including “X-as-a-service,” indicating a major shift in the relationships that semiconductor companies expect to have with their customers. This is a profound shift toward non-traditional models with these new go-to-market strategies providing an innovative way for semiconductor companies to engineer products and generate revenue.

Nineteen percent (19%) of semiconductor companies are developing innovative solutions to enter new markets.

Forty-two percent (42%) of semiconductor companies are focused on new markets and experimenting with new go-to-market strategies.

Fifty-eight (58%) of respondents are focused on existing markets for their transformation strategy and plan to strengthen existing solutions or develop new solutions.

Seven out of every 10 semiconductor companies surveyed are aware of the need for new offerings, including configurable bundles and integrated solutions and licensing options.

Forty-nine percent (49%) of respondents plan to offer usage-based models, subscription models, or outcome-based models to monetize the primary offering in the transformational business model.

“This is a time of great change for the semiconductor industry, and there are many opportunities for leaders to improve how their organizations are executing new business strategies. It is important to look at the journey holistically with a clearly articulated plan. Consider all aspects of the transformation, and how it will impact your employees and your customers. A well-established vision will increase the chance of success of the entire endeavor.”

– Brandon Kulik, principal, Deloitte Consulting LLP’s U.S. technology, media and telecommunications industry practice, semiconductor industry lead

Digital proliferation

Semiconductor companies seek to substantially change their operating models in their transformation by advancing their digital footprint, skills and collaboration capabilities to support an expanding portfolio of products, offerings and markets. Digital adoption will provide actionable insights from the increasingly vast amounts of product and customer data curated from expanding markets and portfolios.

Seventy-four percent (74%) of respondents rank product development as most critical to an organization’s transformation strategy.

Skills and development come in first, at 49%, as the aspect of an organization’s people/talent that is most critical to transformation.

Culture and environment rank second, at 26%, as another aspect of an organization’s people/talent critical to transformation.

Forty-four percent (44%) of executives say that end-to-end data visibility is the core technology most important to a company’s transformation.

Data analytics ranks second, at 40%, among the core technologies important to a company’s transformation.